Behind on Mortgage Payments in New Jersey: What Homeowners Should Know

Falling behind on mortgage payments can be stressful, but it does not automatically mean foreclosure. In New Jersey, homeowners who miss payments often still have time and options — especially if they act early.

This page explains what happens when mortgage payments are missed in New Jersey, what steps typically come next, and what options homeowners may want to consider before the situation escalates.

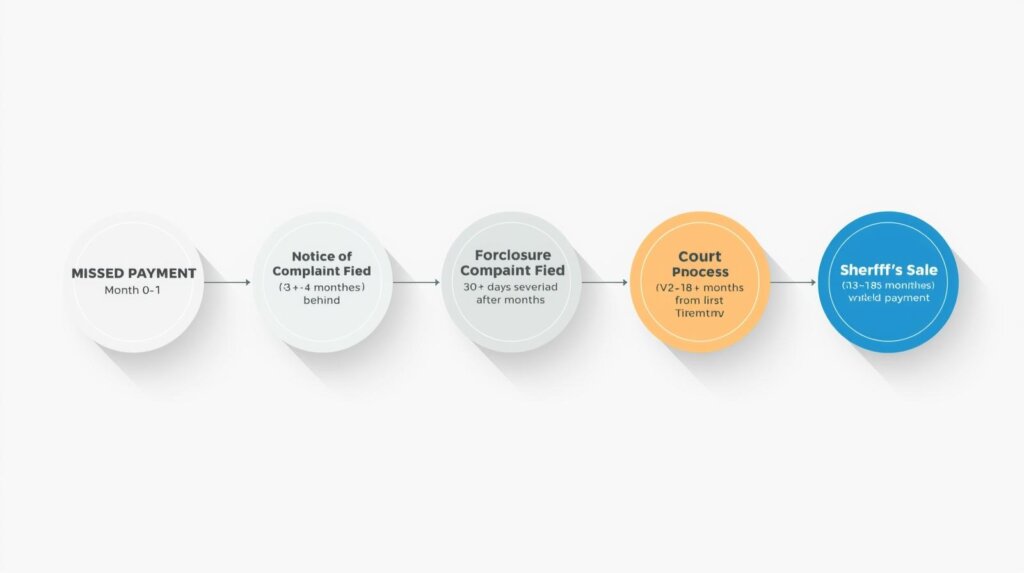

What Happens After You Miss a Mortgage Payment in New Jersey

Missing a single payment usually does not trigger immediate foreclosure. Most lenders allow a short grace period before late fees are added.

If payments continue to be missed:

- Late fees may accrue

- The loan may enter default

- The lender may send formal notices

- Credit reporting may be affected

In New Jersey, lenders must follow specific legal steps before foreclosure can begin, which often provides homeowners time to respond.

When Does Foreclosure Typically Start in New Jersey?

New Jersey is a judicial foreclosure state. This means a lender must go through the court system to foreclose on a property.

Before filing a foreclosure lawsuit, lenders are generally required to send a Notice of Intent to Foreclose, which outlines:

- The amount owed

- The default status

- A window of time to address the issue

At this stage, foreclosure has not started yet, and homeowners often have more flexibility.

Options Homeowners May Have When Behind on Payments

The right option depends on the homeowner’s financial situation, goals, and how far behind the loan is.

Common paths homeowners explore include:

- Catching up through repayment plans

- Loan modification or forbearance

- Selling the home before foreclosure begins

- Exploring alternatives with the lender

Each option comes with different requirements and timelines. What works for one homeowner may not work for another.

Can You Sell a House If You’re Behind on Mortgage Payments?

In many cases, yes. Being behind on payments does not automatically prevent a home from being sold.

Selling before foreclosure begins may allow a homeowner to:

- Resolve the mortgage balance

- Avoid further legal action

- Reduce long-term financial impact

- Move forward with clarity

Timing and equity matter, which is why understanding options early is often beneficial.

Why Acting Early Matters

Mortgage situations rarely improve on their own. The earlier a homeowner understands their position, the more control they usually have.

Waiting can lead to:

- Fewer available options

- Higher costs

- Increased legal pressure

Learning what may be possible early allows homeowners to make informed decisions rather than rushed ones.

If Foreclosure Has Already Started

If a foreclosure complaint has already been filed, the situation becomes more time-sensitive and options may change.

→ Learn how to avoid foreclosure in New Jersey

(This link is intentional and prevents confusion.)

Talk Through Your Situation

Every mortgage situation is different. This page is meant to provide general information — not pressure or one-size-fits-all solutions.

If you’re behind on mortgage payments in New Jersey and want to understand what steps may make sense for your situation, a conversation can help clarify your options.

Learn More About Selling Options Across New Jersey

If you’re behind on mortgage payments and want to explore all available selling options, you can learn more about how Garden State Cash Homes helps homeowners throughout New Jersey on our main website.

Disclaimer

This content is for informational purposes only and does not constitute legal or financial advice. Homeowners facing mortgage default should consult with a qualified attorney, housing counselor, or financial professional to discuss their specific situation.