Can You Sell Your Home With a Lien on It in New Jersey?

Yes — you can sell a house with a lien on it in New Jersey, but the lien must be properly addressed before the buyer can receive clear title. Liens are a common issue for NJ homeowners dealing with back taxes, unpaid debts, contractor disputes, or legal judgments, and they do not automatically prevent a sale. However, how a lien is handled can affect the timeline, proceeds, and even whether a traditional buyer can move forward.

Understanding how liens work under New Jersey law is the first step toward selling your home successfully.

What Is a Lien? (New Jersey–Specific Explanation)

A lien is a legal claim placed against a property to secure payment of a debt. In New Jersey, liens attach to the property itself, not just the homeowner, which means they must be resolved before ownership can legally transfer.

Liens are recorded with the county clerk’s office in the county where the property is located and are typically discovered during a title search when a home is being sold or refinanced. Until a lien is released, it clouds the title and prevents a buyer or lender from obtaining clear ownership rights.

Types of Liens That Can Attach to a Property in New Jersey

Mortgage Lien (First Mortgage)

This is the primary loan secured by the property. It is almost always paid first at closing after municipal tax liens. If the sale price covers the mortgage balance, it is satisfied and released.

Second Mortgage or HELOC

These are additional loans secured by the property. They are paid after the first mortgage. If there is not enough equity, the lender may need to approve a reduced payoff.

Property Tax Lien (Tax Lien Certificate)

If property taxes are unpaid, a tax lien may exist. These liens generally have very high priority and must be paid at closing. If a tax lien certificate has been sold, the redemption amount must be satisfied.

IRS or State Tax Lien

Federal or state tax liens attach to the property for unpaid taxes. These must typically be paid or formally released before title can transfer. In some cases, negotiation or discharge approval may be required.

Judgment Lien

If a creditor wins a lawsuit and records a judgment, it may attach to the property. Judgment liens are paid after higher-priority liens — but they still must be addressed before closing.

Mechanic’s Lien

Filed by contractors who were not paid for work performed. These liens can delay a sale if disputed and may require settlement before closing.

HOA or Condo Association Lien

Unpaid association dues can result in a lien. A portion may have limited priority under New Jersey law and must be paid before closing.

Municipal Utility or Special Assessment Liens

Unpaid water, sewer, or local improvement charges can attach to the property. These often must be satisfied at closing.

Child Support Lien

Unpaid child support obligations can result in a lien that attaches to real property owned by the obligated party. These liens are typically enforced through court systems and must be satisfied or formally resolved before a sale can close.

How Liens Affect Selling a Home vs. Refinancing in NJ

Selling and refinancing are treated differently when a lien is present.

When refinancing, lenders typically will not approve a loan until all liens are paid in full beforehand. This often leaves homeowners stuck if they lack the cash to resolve the lien upfront.

When selling, liens are commonly paid off at closing using the sale proceeds. This is why many homeowners choose to sell their house fast in New Jersey rather than attempt to refinance when liens are present.

When Do You Have to Pay Off a Lien in New Jersey?

In most New Jersey real estate transactions, liens must be paid, settled, or otherwise released before or at closing. The buyer must receive clear and marketable title, which means no outstanding claims can remain attached to the property.

A lien does not always need to be paid before listing the home, but it must be resolved before ownership transfers. This is typically coordinated by the title company or real estate attorney handling the closing.

What Happens If Liens Exceed the Home’s Equity?

If the total amount of liens on a New Jersey property is greater than the home’s market value, selling may still be possible — but it becomes more complex.

In these cases, options may include:

- Negotiating lien payoffs with creditors

- Pursuing a short sale if a mortgage is involved

- Working with lienholders to accept less than the full balance

- Selling to a buyer experienced with distressed and negative-equity properties

Each scenario depends on the type of lien, the creditor involved, and the property’s value. Some sellers choose to sell their New Jersey house for cash because cash sales remove lender approval requirements and allow liens to be addressed directly at closing.

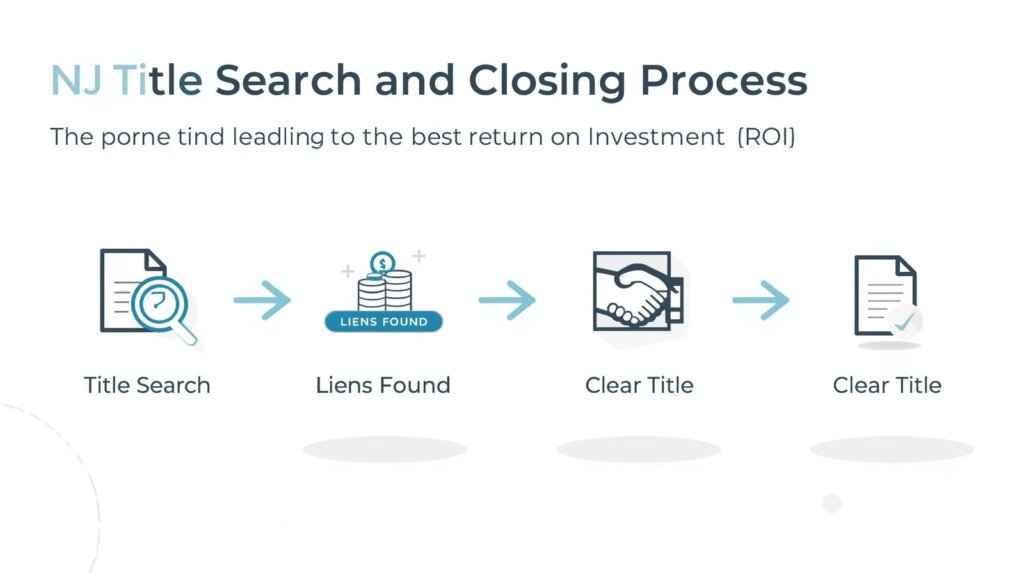

The New Jersey Title Search and Closing Process

In New Jersey, liens are uncovered through a title search ordered by the buyer or their title company. This search reviews public records to identify any claims, judgments, or unpaid obligations tied to the property.

At closing:

- Sale proceeds are distributed

- Outstanding liens are paid or settled

- Lien releases are recorded with the county

- Clear title is transferred to the buyer

If a lien is discovered late in the process, it can delay closing, which is why addressing liens early is critical.

Alternatives If You Can’t Resolve a Lien Easily

Homeowners facing lien challenges may still have options depending on their situation.

Some creditors may agree to accept less than the full balance through negotiation. Others may require a short sale approval if the mortgage balance exceeds the home’s value. In many cases, homeowners choose to sell a house as-is in New Jersey to avoid repairs, agent commissions, and prolonged timelines.

Selling a New Jersey House With a Lien

Selling a house with a lien in New Jersey is possible, but it requires the right approach. Understanding the type of lien, how it affects title, and how it can be resolved at closing can help homeowners avoid unnecessary delays and complications.

Many New Jersey homeowners facing lien issues choose to sell their homes as-is for cash to avoid repairs, commissions, and financing obstacles. This approach can be especially helpful when time, legal complexity, or financial pressure is involved.

Frequently Asked Questions

Can you sell a house with a lien on it in New Jersey?

Yes. A home with a lien can be sold in New Jersey, but the lien must be resolved before the buyer receives clear title.

Do liens have to be paid before closing in NJ?

Not always. Many liens are paid at closing using the sale proceeds rather than being paid upfront.

Will a lien stop my home from closing?

Only if it is not addressed in time. Identifying liens early helps prevent closing delays.

Does selling for cash help with lien issues?

Yes. Cash sales often simplify lien resolution because there is no lender approval required.

Disclaimer

The information provided on this page is for general informational purposes only and is not intended as legal, tax, or financial advice. Laws and procedures related to property liens in New Jersey may vary based on individual circumstances. Garden State Cash Homes LLC is not a law firm, tax advisor, or real estate brokerage. Homeowners should consult with a qualified New Jersey real estate attorney, title company, or licensed professional regarding their specific situation before making any real estate decisions.